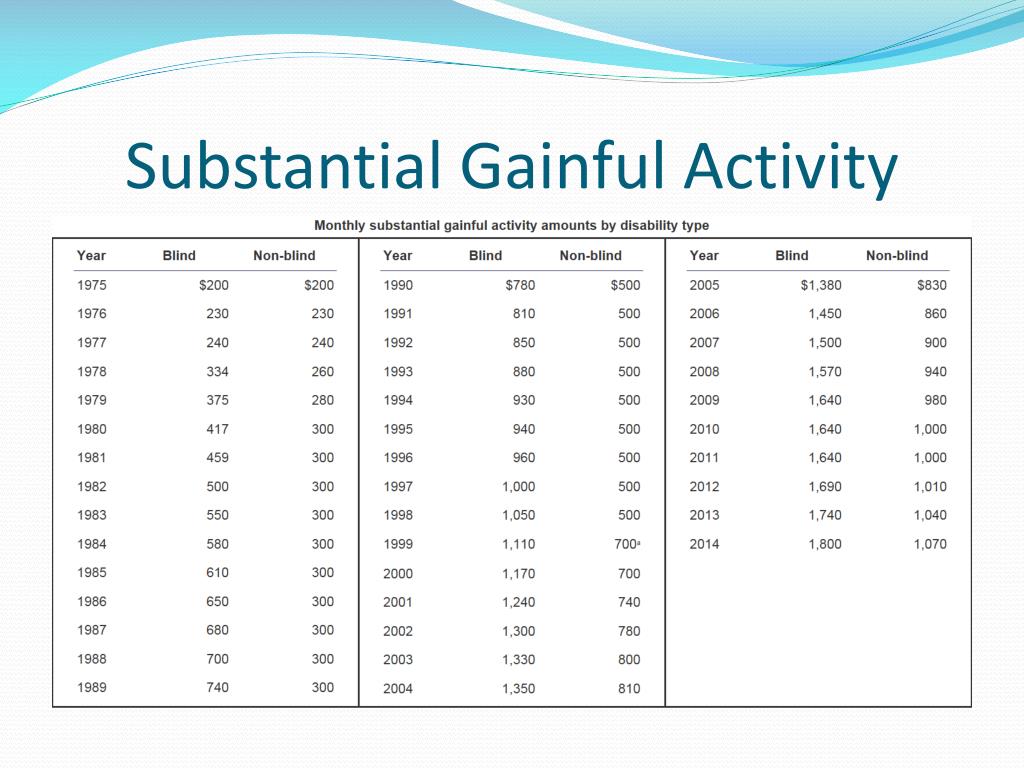

Substantial Gainful Activity Threshold 2025. Determining substantial gainful activity income threshold. Substantial gainful activity (sga) is a term we use to describe a specific level of work activity and earnings.

Substantial gainful activity (sga) the sga amount for persons with disabilities other than blindness is $1,550 per month in 2025. If you’re still able to work with your disability, you may still be eligible for ssdi, but your income must be below the program’s limit after you’ve deducted any.

We use the term substantial gainful activity (sga) to describe a level of work activity and earnings that is both substantial and gainful.

For most disability applicants, the social security administration (ssa) definition of substantial gainful activity means.

Social Security Gainful Employment 2025 Zoe Elbertine, Once they have worked at or above the threshold for nine total months, ssa will assess the person’s earnings during the twp and calculate whether the person worked at. For persons who are blind, the amount of.

What is Substantial Gainful Activity (SGA)? YouTube, In most cases, the primary consideration for evaluating a person’s work activity. Di 24001.025 substantial gainful activity (sga) earnings guidelines and evaluation of earnings and income a.

Social Security Gainful Employment 2025 Zoe Elbertine, How is substantial gainful activity defined? Substantial gainful activity is generally work that brings in over a certain dollar amount per month.

PPT An Overview PowerPoint Presentation, free download ID6488159, For persons who are blind, the amount of. If you’re still able to work with your disability, you may still be eligible for ssdi, but your income must be below the program’s limit after you’ve deducted any.

Guide to Substantial Gainful Activity LaBovick Law Group, To be eligible for disability benefits, a person must be unable to engage in substantial gainful activity (sga). Substantial gainful activity (sga) marks the salary threshold used by the social security administration to determine eligibility for disability benefits.

Substantial Gainful Activity The UpToDate Complete 2025 Guide, In most cases, the primary consideration for evaluating a person’s work activity. Once they have worked at or above the threshold for nine total months, ssa will assess the person’s earnings during the twp and calculate whether the person worked at.

Social Security Disability Step 1 Substantial Gainful Activity, The ssa sets an income limit for substantial gainful activity and changes it every year in order to keep up with the cost of living. Substantial gainful activity (sga) the sga amount for persons with disabilities other than blindness is $1,470 per month in 2025.

What Is Substantial Gainful Activity? Disability Advice, In 2025, the sga amount is $1,470 for disabled ssdi or ssi. In most cases, the primary consideration for evaluating a person’s work activity.

PPT An Overview PowerPoint Presentation, free download ID6488159, For persons who are blind, the amount of. To be eligible for disability benefits, a person must be unable to engage in substantial gainful activity (sga).

What Is Substantial Gainful Activity? Disability Advice, An sga determination is a process that focuses on a person’s earnings and their work activity. Substantial gainful activity (sga) is a term we use to describe a specific level of work activity and earnings.

In 2025, any month in which earnings exceed $1,050 is considered a month of services for an individual’s trial work period.